Hello Folks its been a long time since my last post & a lot has happened in the Markets with the Sensex Hitting 21k in diwali & the current correction to 19k levels. I have been very busy with work off late and hence i couldn't post but at the same time i have been looking at a lot of companies. Hopefully i shall be more active from now on.

Apologies again for my delay in posting this Analysis of MOIL with just 1 day to the close of the Issue.Hopefully it would help some of you who are still confused whether to invest or not. I went through the Prospectus, various research reports & Annual Reports to come of with the following write up.

Company Profile

MOIL, a Miniratna PSU, accounts for nearly 50% of India’s Manganese ore production. Currently, MOIL operates 10 mines located in Maharashtra (six mines) and Madhya Pradesh (four mines). In addition to Manganese ore production, the company has diversified into high value-added products HCFM and EMD. The company also operates two wind power plants, with total capacity of 20MW, in Nagda hills and Ratedi hills, Madhya Pradesh.

Apologies again for my delay in posting this Analysis of MOIL with just 1 day to the close of the Issue.Hopefully it would help some of you who are still confused whether to invest or not. I went through the Prospectus, various research reports & Annual Reports to come of with the following write up.

Company Profile

MOIL, a Miniratna PSU, accounts for nearly 50% of India’s Manganese ore production. Currently, MOIL operates 10 mines located in Maharashtra (six mines) and Madhya Pradesh (four mines). In addition to Manganese ore production, the company has diversified into high value-added products HCFM and EMD. The company also operates two wind power plants, with total capacity of 20MW, in Nagda hills and Ratedi hills, Madhya Pradesh.

The IPO entails issue of 3.36cr equity shares priced in the band of Rs 340–375. The issue of 3.36cr equity shares by the central and state governments represents 20% of the company’s total outstanding share capital. The company will not receive the offer proceeds, as the proceeds are part of the government's divestment plan.

Strengths

Financial Performance

MOIL Registered an Impressive Growth in Sales & profits of 22.9% CAGR & 41.8% CAGR respectively from 2001 - 2010 . The chart below shows the trend of Sales & Net Profit Growth. As we can see the growth has been lumpy & the Net profits have gone up significantly since 2005 mainly on account of higher Margins. The Topline grew by 23.% CAGR in past 5 years & 37.7% in past 3 years showing how good the recent years have been for MOIL. Similarly ,the net profits grew by 29.7% CAGR & 52.5% CAGR in last 5 & 3 years respectively.

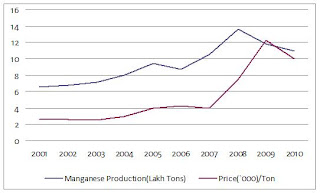

This can be understood better when looked at with the physical production of Manganese ore & the Cost realization(`000)/Tonne as shown in the chart below from 2001-2010.While the Managnese production grew by just 5.9% CAGR the Price/tonne went up by 24.03% CAGR during the same period. MOIL due to its dominance & quality ore made most of this boom. However the demand grew so much that India was a net Importer of Manganese in the last 3 years.

MOIL being one of the lowest cost producers of Manganese in the world ,has very high Net Profit Margins & Return in Equity(ROE) as shown in the chart below. However between 2001 - 2004 the NPM was just around 9 - 12% but Jumped to 31% in 2005 & has stayed between 31-48% between 2005-2010. The ROE has stayed between 28-59% during the same period. This was mainly on account of better price/tonne as shown above & improved efficiency.

Valuation

Considering the amazing response the Issue has already seen its safe to assume that the price will be fixed at upper band of Rs 375 which translates to a price of Rs 356.25 for Retail Investors after the 5% discount. This translates to a Market Cap of 5985 Crs,however due to the 1763 Crs Cash on books the actual value of the company turns out to be 4222Crs . The table below shows the various important valuation metrics for TTM & 3,5,10 Year averages wherever data was available.

TTM 3Yr AVG 5yr AVG 10yrs Avg

P/E 9.07 7.83 11.34 20.35

P/CF 16 8.85 12.52

P/FCF 17 10.11 14.54

P/BV 2.1

Div Yld 1.57%

MOIL looks attractively priced whichever way one looks at it on absolute terms. Especially on Trailing Twelve Months(FY10) & 3yrs avg basis it looks quite cheap for a company with such high ROE and growth. Its important to look at average valuations also as this is essentially a commodity company which is cyclical in nature. It looks reasonably priced even w.r.t. 5yr avg considering the past growth it has had. On a relative basis there is no comparable competitor in India, however MOIL is cheaper than other mining companies like CIL,NMDC,OMDC,Sandur Manganese etc. Globally, Citic a direct peer of MOIL got listed in November in Hong Kong at a P/E of 42 & P/BV of 7. Further when compared to other Global Mining biggies who have lower margins than MOIL it still appears attractively.

Conclusion

Value Investors generally tend to ignore IPOs. However as one saw with the IPO of Coal India, fundamentally good companies priced reasonably make for good investments. MOIL i believe fits the bill too what with a 5 star rating from CARE highlighting its fundamental strength and an attractive price. While i am not sure how much listing gains MOIL would fetch but i am confident it makes for a good long term bet.

Strengths

- Largest producer of manganese ore in India with access to significant reserves : MOIL accounts for nearly 50% of India’s manganese ore production, distantly followed by Tata Steel (16%), Sandur Manganese (10%) and Rungta mines (7%). The company holds approximately 17.0% of the proved reserves of manganese ore in India which is 21.7 million tonnes of proved and probable reserves and a total of 69.5 million tonnes of measured, indicated and inferred mineral resources of manganese ore. 55.0% of MOIL's ore reserves have an average manganese content of 40.0% or higher & 27.5% have an average manganese content of 36.0%-39.9% & none of the mines produce low grade manganese (i.e., below 30.0% manganese content).

- Well positioned to capture the growth potential of the Indian steel industry : As more than 90% of Manganese world over is used in Steel Making, the fortunes of MOIL have been tied to the domestic steel industry. CARE Research expects domestic steel demand to increase at a 9.2% CAGR over FY2011–15. Thus, demand for manganese ore is expected to increase at a 9.0% CAGR over the next two-three years. This is an indirect way to play the Infrastructure story to unfold in India.MOIL due to its significant reserves, is well positioned to serve the increase in demand expected from the steel industry.

- Low cost and efficient operations : As the largest producer of manganese ore by volume in India, MOIL is able to achieve economies of scale in procurement of input materials, production efficiency, marketing, sales, and other aspects of its operations. The Dongri Buzurg mine is fully mechanized and all other mines are semi-mechanized. Mechanization allows for higher recovery rates, permitting an increasing percentage of manganese ore to be recovered by way of crushing, screening and sorting of waste, thus improving productivity and higher sales. The company owns all the equipment it uses in its operations and third parties are primarily used for overburden removal. This gives MOIL flexibility in operations as it doesn't depend on third parties for operations.All of the above elements favor cost-efficient production, which increases MOIL's profitability and make it one of the lowest cost producers of Manganese ore.

- Strategic location of mines provides it with advantages : MOIL's mines are located in central India, in the states of Maharashtra and Madhya Pradesh which have well-developed road and rail infrastructure. The central location gives it a marketing advantage over competitors, as it facilitates transportation of products, resulting in lower cost and faster time of delivery for its customers. Also, higher transportation costs associated with imported manganese ore provides MOIL with improved competitive positioning in the market.

- Solid Financials : MOIL is a debt free Company with 1763 Crs Cash on its books. It benefits from a strong liquidity position that gives it significant flexibility & ability to pursue acquisitions abroad if required. MOIL has enjoyed Healthy Net profit Margins ranging between 43-48% in last 3 years. It also has excellent cash flows & is Free Cash Flow positive.The Company's strong Balance Sheet and cash flows from operations provide it with sufficient resources to fund projects, working capital requirements and maintain a healthy level of cash on its balance sheet.

- Strong capabilities for exploration, mine planning and research development : The company is actively involved in exploration and development activities to increase its proved manganese ore reserves. An area of 814.71 hectares in the State of Maharashtra has been reserved for MOIL by a notification from the Ministry of Mines. It has applied for prospecting licenses with respect to this area. MOIL has a planning division that includes geologists and mining engineers that focuses on exploration activities at potential mineral deposits.

- Experienced senior management , large pools of skilled manpower & Stable Staff Cost : MOIL has an experienced management team with an average of over 20 years of experience in the mining industry and skilled employees who possess significant industry experience. It maintains good relations with its employees and unions and has not lost any significant employee time due to strikes or labor unrest for the past 25 years. As compared to other PSUs, MOIL is relatively insulated from volatility in its salary cost, as the wage agreement is effective for a 10-year period. The wage agreement for non-executive employees will expire on July 31, 2017 and that for executive employees will expire on December 31, 2016 .Employee costs represent the most significant portion of its operating expenses.

- Expansion through capacity addition and JVs for Forward Integration : MOIL has undertaken expansion plan at its existing mines to augment its production capacity to 1.5mn tonnes by FY2016E from the current levels of 1.1mn tonnes. At Balaghat, Gumgaon and Munsar, shaft sinking and deepening of existing shafts is underway. MOIL intends to expand its value-added capacity and, thus, has entered into JVs with SAIL and Rashtriya Ispat Nigam Ltd. (RINL) to set up two ferro-alloy plants in Chhattisgarh and Andhra Pradesh. The proposed installed capacity in case of the JV with SAIL is 1,06,000 tonnes and that in case of RINL is 57,500 tonnes. The plants are expected to be commissioned by June–July 2012. These capacities will enable MOIL to increase sales of value-added products and also improve margins.

- Fortunes tied to Steel Industry : The manganese ore industry is highly dependent on the prospects of the steel industry, as 94% of manganese ore produced is used in the production of ferro alloys, which is consumed in the steel industry (90% of ferro alloy produced is used in the steel industry). Manganese ore prices have been very volatile historically and had fallen by more than 50% during the downturn in 2008. Any adverse changes in steel demand can have a negative bearing on manganese ore prices.

- Client Concentration Risk : MOIL's top ten customers represent approximately 51.5% of their sales of manganese ore. Key customers include Maharashtra Elektrosmelt Limited and Bhilai Steel Plant (“Bhilai”), which are both subsidiaries of SAIL and which together accounted for 22.1% of sales revenue . If MOIL fails to enter into new agreements on acceptable terms with any of its top ten customers, and SAIL in particular, its results of operations and prospects could be materially and adversely affected.

- Implementation of new mining policy to include 26% profit sharing : To curb illegal mining and fast-track approvals for mining rights, the government has proposed a new bill that requires miners to share 26% of profits with local people affected by their mining projects. Recently, the bill has received an in-principle approval from the Group of Ministers (GoM) and the proposed bill is expected to be placed in the parliament for approval during the upcoming winter session. Although the proposed bill lacks clarity, the implications of the new profit-sharing rule on MOIL’s earnings could be severe.

- Limited mine life for some of the operating mines : The reserves at Kandri, Beldongri, Chikla and Tirodi are expected to exhaust in the next 6–9 years based on FY2010 production levels. These mines produced 32.5% of the total manganese ore in FY2010. Thus, in the absence of any significant reserves accretion at the existing or new mines, the company’s performance could be affected in the long term.

- Other Mining Related Risks : Mining operations are subject to a number of operating risks like poor mining conditions resulting from geological, hydrologic or other conditions; adverse weather and natural disasters, such as heavy rains, flooding and other natural events affecting operations, safety and environmental regulations or changes in interpretation or implementation of current regulations.Seven of the mines MOIL currently operates are underground mines.Underground mining activities are inherently risky and hazardous and prone to fires and explosions.

Financial Performance

MOIL Registered an Impressive Growth in Sales & profits of 22.9% CAGR & 41.8% CAGR respectively from 2001 - 2010 . The chart below shows the trend of Sales & Net Profit Growth. As we can see the growth has been lumpy & the Net profits have gone up significantly since 2005 mainly on account of higher Margins. The Topline grew by 23.% CAGR in past 5 years & 37.7% in past 3 years showing how good the recent years have been for MOIL. Similarly ,the net profits grew by 29.7% CAGR & 52.5% CAGR in last 5 & 3 years respectively.

This can be understood better when looked at with the physical production of Manganese ore & the Cost realization(`000)/Tonne as shown in the chart below from 2001-2010.While the Managnese production grew by just 5.9% CAGR the Price/tonne went up by 24.03% CAGR during the same period. MOIL due to its dominance & quality ore made most of this boom. However the demand grew so much that India was a net Importer of Manganese in the last 3 years.

MOIL being one of the lowest cost producers of Manganese in the world ,has very high Net Profit Margins & Return in Equity(ROE) as shown in the chart below. However between 2001 - 2004 the NPM was just around 9 - 12% but Jumped to 31% in 2005 & has stayed between 31-48% between 2005-2010. The ROE has stayed between 28-59% during the same period. This was mainly on account of better price/tonne as shown above & improved efficiency.

I had the cash flow data of MOIL for only the past 5 years during which it exhibited excellent cash flows and healthy Free cash flow. The chart below shows the Free Cash Flows and net profits between 2006-2010. With the kind of Free cash MOIL has been able to generate one can be rest assured that it will have no problems paying dividends & the cash balance is likely to grow in the future .

Valuation

Considering the amazing response the Issue has already seen its safe to assume that the price will be fixed at upper band of Rs 375 which translates to a price of Rs 356.25 for Retail Investors after the 5% discount. This translates to a Market Cap of 5985 Crs,however due to the 1763 Crs Cash on books the actual value of the company turns out to be 4222Crs . The table below shows the various important valuation metrics for TTM & 3,5,10 Year averages wherever data was available.

TTM 3Yr AVG 5yr AVG 10yrs Avg

P/E 9.07 7.83 11.34 20.35

P/CF 16 8.85 12.52

P/FCF 17 10.11 14.54

P/BV 2.1

Div Yld 1.57%

MOIL looks attractively priced whichever way one looks at it on absolute terms. Especially on Trailing Twelve Months(FY10) & 3yrs avg basis it looks quite cheap for a company with such high ROE and growth. Its important to look at average valuations also as this is essentially a commodity company which is cyclical in nature. It looks reasonably priced even w.r.t. 5yr avg considering the past growth it has had. On a relative basis there is no comparable competitor in India, however MOIL is cheaper than other mining companies like CIL,NMDC,OMDC,Sandur Manganese etc. Globally, Citic a direct peer of MOIL got listed in November in Hong Kong at a P/E of 42 & P/BV of 7. Further when compared to other Global Mining biggies who have lower margins than MOIL it still appears attractively.

Conclusion

Value Investors generally tend to ignore IPOs. However as one saw with the IPO of Coal India, fundamentally good companies priced reasonably make for good investments. MOIL i believe fits the bill too what with a 5 star rating from CARE highlighting its fundamental strength and an attractive price. While i am not sure how much listing gains MOIL would fetch but i am confident it makes for a good long term bet.

Disclosure: I have Applied for MOIL IPO. Please read the Disclaimer